Who we are

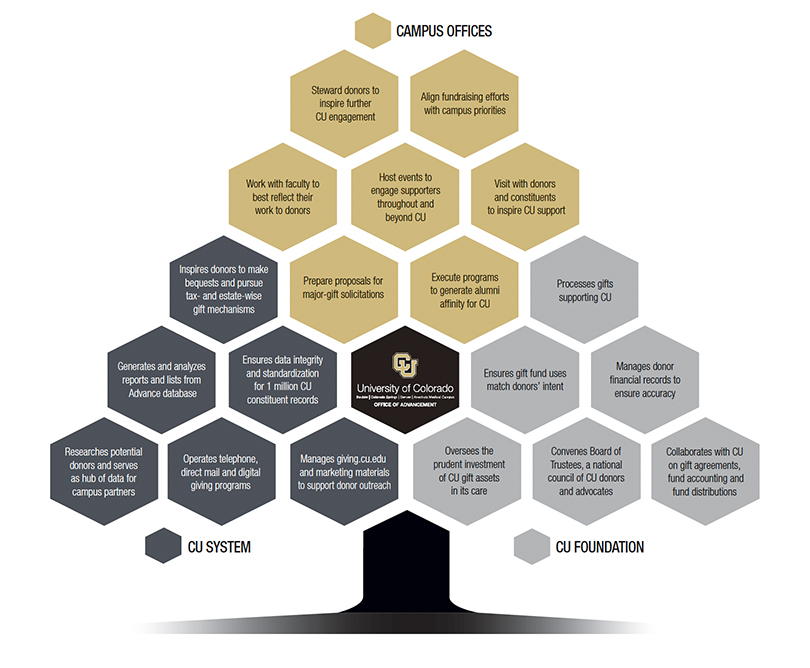

The nonprofit University of Colorado Foundation works collaboratively with the University of Colorado to receive, manage and invest private support that benefits CU. Donors’ gifts are directed to the Foundation, which is a legally separate 501(c)(3) charitable organization that functions as a part of CU Advancement.

The CU Office of Advancement guides a vital and clear mission: We aspire to unite benefactors with their passions, elevate grand ideas and prudently manage philanthropy—all to spark enduring support of a university that creates transformative impact in our communities and around the world.

Investing in the Future

Investing in the Future

Thank you for considering establishing or contributing to an endowment at the University of Colorado. Donors’ contributions are an investment in CU, providing essential funding for the people, places and programs that shape the university now and into the future. Your support ensures that CU can offer the highest quality education, research, clinical care and community service while helping CU weather year-to- year budget unpredictability.

CU’s long-term vitality relies not just on charitable gifts, but also on the responsible management of donors’ philanthropy. The CU Foundation and the CU Office of Advancement support this strategy in two fundamental ways: by inspiring donors to support their passions, and by managing endowments to generate steady long-term funding.

In this overview, you’ll learn how CU’s endowments operate, how endowment funds are managed and invested, and how gifts enable the university to improve our communities, Colorado and world.

CU Foundation Mission, Vision and Values

CU Foundation Mission, Vision and Values

Our Mission

To receive, manage and prudently invest private support for the benefi t of the University of Colorado.

Our Vision

To promote private support for the University of Colorado, manage and grow the endowment, ensure the appropriate use of funds, engage volunteer leadership and pursue the best governance practices.

Our Values

- Act with integrity

- Deliver exceptional customer service

- Be innovative and efficient every day

- Value and respect the thoughts and opinions of others

- Be excellent stewards of the financial resources entrusted to us

University of Colorado Endowments

University of Colorado Endowments

Thousands of individual endowments benefit hundreds of CU programs. These individual endowments are collectively known as the CU endowment.

Each individual endowment generates stable support for an individual university priority that’s specified by that endowment’s donor.

Endowment purposes include scholarships, research, health and wellness programs, faculty chairs and more.

What is an endowment?

An endowment is a gift to support CU that lasts forever. An amount equal to a percentage of an endowment’s market value is distributed annually to the CU program designated by the endowment donor, and the remaining balance is invested prudently to maximize its long-term growth. Year after year, distributions from endowments continue to support the intended CU programs.

What is an endowment?

An endowment is a gift to support CU that lasts forever. An amount equal to a percentage of an endowment’s market value is distributed annually to the CU program designated by the endowment donor, and the remaining balance is invested prudently to maximize its long-term growth. Year after year, distributions from endowments continue to support the intended CU programs.

May donors direct how gifts are used?

Yes. When creating a new endowment, a donor may specify how the university will use distributions from the endowment. We work closely with donors to match their intentions with the university program that they choose to endow.

May donors direct how gifts are used?

Yes. When creating a new endowment, a donor may specify how the university will use distributions from the endowment. We work closely with donors to match their intentions with the university program that they choose to endow.

May CU spend endowment distributions in ways other than as directed by a donor?

No. In gift agreements donors specify the particular purposes of their endowment, and the university is legally bound to honor donor wishes.

May CU spend endowment distributions in ways other than as directed by a donor?

No. In gift agreements donors specify the particular purposes of their endowment, and the university is legally bound to honor donor wishes.

Will donors receive regular updates on the status of their endowments?

Yes. We are committed to accountability and transparency and so we provide annual reports on the status of individual endowments. The CU Foundation also publishes quarterly progress reports on the investment performance of the CU endowment. Visit giving.cu.edu/cufoundation to view these reports.

Will donors receive regular updates on the status of their endowments?

Yes. We are committed to accountability and transparency and so we provide annual reports on the status of individual endowments. The CU Foundation also publishes quarterly progress reports on the investment performance of the CU endowment. Visit giving.cu.edu/cufoundation to view these reports.

How does an endowment work?

How does an endowment work?

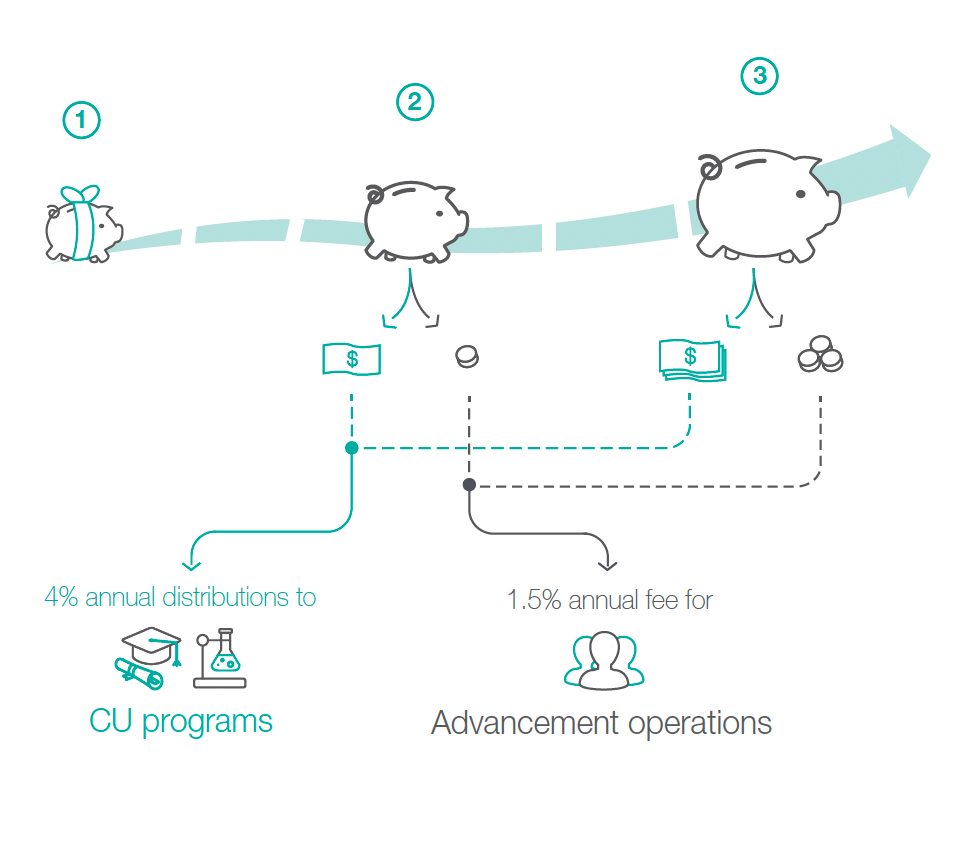

Managing an endowment balances two goals:

- providing the maximum amount of current annual support for CU programs

- maintaining its value through long-term investments

Consider this hypothetical example:

Consider this hypothetical example:

-

A donor fully funds an endowment with a $200,000 gift to support student scholarships.

-

On July 1 each year, 4 percent of the endowment’s fair market value as of the prior December 31 is distributed for spending in support that scholarship program.

-

Imagine the endowment’s value has increased to $210,000 after its first year. It would distribute $8,400 in scholarship funding that year.

-

If after several years, its value grows to $250,000, the endowment would distribute $10,000 in scholarship funding.

-

-

All the while, the endowment’s principal balance is continually invested to maintain its value and fund the scholarship program year after year.

How are an endowment’s distributions calculated?

Distributions are calculated as an amount equal to 4% of an endowment’s trailing 36-month average fair market value as of the December 31 of the year preceding the distribution. Distributions from endowments that are less than three years old are calculated using the following adjusted formula: an amount equal to 4% of an endowment’s trailing monthly average market value for the number of months the endowment has been invested as of the December 31 of the year preceding the distribution.

Is it possible that an endowment won’t make a distribution?

Yes. The Foundation will suspend distributions when a pure endowment’s fair market value is less than 90% of its historic gift value.

Do endowments support fundraising operations?

Yes. Since at least 1980, we have deployed a commonly used funding model to support CU’s advancement operations: revenue from assessments on the endowments provide operating support for CU Advancement. Each endowment annually pays an advancement support assessment equal to 1.5% of the market value of the endowment as of the preceding December 31.

Long Term Investment Pool

Long Term Investment Pool

Because endowments are invested for long- term growth and managed under stringent guidelines, the university benefi ts from reliable streams of income in the years to come.

How is the endowment invested?

How is the endowment invested?

The principal accounts of all endowments are invested in a Long Term Investment Pool (LTIP). The LTIP is invested in a diversified portfolio of assets that include public domestic and international equities, private capital, tangible assets like real estate and commodities, inflation-protected securities and hedge funds.

Investing endowments as a pool, rather than individually, enables access to a far wider range of investment opportunities, and with far greater efficiency, than would be possible if endowments were invested individually. Visit giving.cu.edu/cufoundation to read more about the LTIP in the CU Foundation’s investment policy statement.

Who manages the endowment?

The CU Foundation employs an outsourced chief investment officer fi rm—the Agility Group at Perella Weinberg Partners—to manage the LTIP’s investment portfolio. This fi rm operates within the parameters of an investment policy statement and is overseen by the CU Foundation’s Investment Policy Committee and Board of Directors.

Proportion of Endowment Dollars by Category

Your gift counts

When you support the University of Colorado, you provide students, faculty and staff the help to meet tomorrow’s challenges. CU prospers thanks to your generosity.

Learn more

If you’d like to know more about CU’s endowments or how you can make a gift call 303-541-1290